Every U.S. employer is responsible for displaying certain mandatory labor law postings. Meet that responsibility and you’re in the clear, right? Not so fast. What if you outsource HR functions or payroll to another company, or lease workers from a temp or staffing agency? Alternatively, what if your business relies on a contractor’s employees, or you provide your own employees to work at a client’s place of business?

Under a final rule by the Department of Labor (DOL), these types of arrangements may make you a joint employer with the other business. And if so, both entities must follow regulatory guidelines under the Fair Labor Standards Act (FLSA), including minimum wage, overtime pay and workplace postings.

Breaking Down the Final DOL Rule

The latest rule, effective October 5, 2021, rescinded an earlier rule under the Trump administration that attempted to redefine joint employment through a four-factor test. The previous rule experienced tremendous pushback from various states for its modified approach. The final rule, however, references legal and judicial precedent when evaluating joint employer relationships. As a result, more businesses will be considered joint employers going forward, and are expected to meet their equal legal obligations.

Basically, joint employment applies when two separate companies act as the worker’s employer due to sharing of staff and other functions, such as payroll, scheduling and management. An example would be a hotel contracting with a staffing agency for a cleaning staff, which the hotel directly oversees. In this case, the agency and hotel are considered joint employers – and both are responsible for providing full worker protections under the FLSA.

In a joint employment relationship, both employers are responsible for certain legal protections to workers, including minimum wage and overtime pay (and related postings) under the FLSA.

Why the Joint Employer Rule Matters

When two or more businesses share workers, disagreements can arise over which company is responsible for various federal or state employment laws, particularly wage and hour issues. The joint employer rule is designed to reduce uncertainty over this arrangement and clarify who is responsible for their employment protections. As such, joint employers may not only share legal liability, but also an obligation to comply with labor law postings.

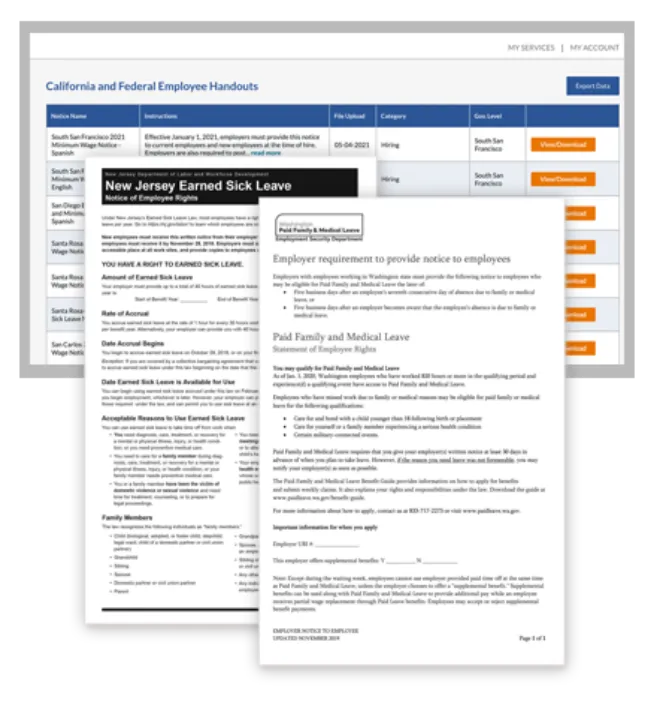

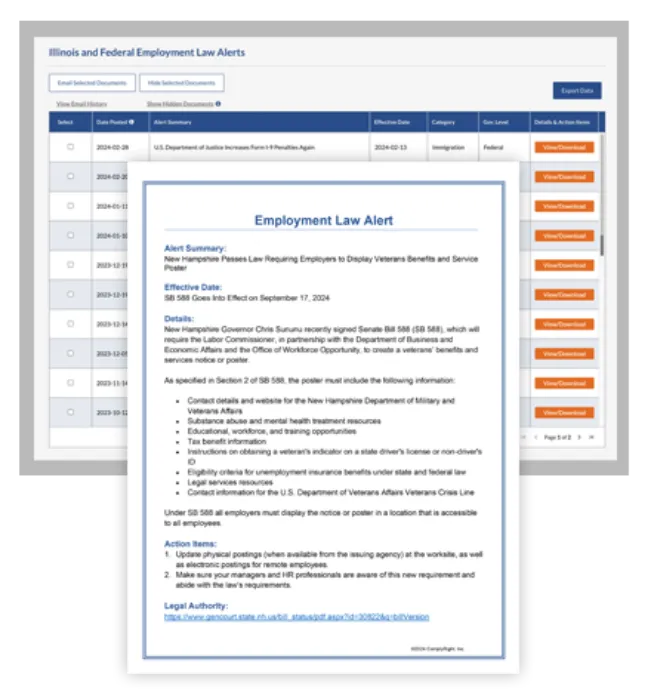

To be clear, workplace posting requirements must be upheld by all parties. This means complete coverage that includes federal, state, county and city postings, any language requirements and all replacement postings as changes occur.

In today’s legal environment, don’t assume your business is “off the hook” regarding possible employment law oversights just because another entity pays your workers or manages their work. Address these matters in contracts with joint employers to ensure all employment laws are being upheld, including the latest posting requirements.

If your business uses a Professional Employer Organization (PEO), you probably already have an agreement in place addressing this. Most PEOs are co-employers (as opposed to joint employers), so they agree to share legal responsibility for employment law compliance, including workplace postings. If you’re unsure, it’s best to check with your PEO to avoid lapses in posting compliance.

Easily Meet Every Posting Requirement

Rather than take on the staggering task of maintaining posting compliance on your own, consider using a reputable service provider. Poster Guard® Compliance Protection guarantees worry-free labor law posting compliance for employers large and small. You’ll receive a complete, up-to-date federal, state and local (city/county) poster set upon enrollment, as well as replacement posters every time a mandatory change occurs – automatically, free of charge – for a full year. It’s a smart solution for you, as well as any agency or business you may work with as a joint employer.