The federal minimum wage hasn’t changed since 2009, but it’s a very different situation in many states, counties and cities. As of mid-2023, nearly 30 states, the District of Columbia and more than 80 counties and cities have implemented minimum wage rates higher than the federal rate of $7.25/hour.

If you operate across many jurisdictions, this flurry of separate minimum wage laws creates a unique compliance challenge. Yet it’s essential to keep up with them because when federal, state and local minimum wage laws differ, you’re legally required to pay the most generous rate to your hourly, nonexempt workers.

Overview of State and Local Minimum Wage Changes in Past Year

The trend toward higher state and local minimum wage laws is largely due to inaction on the federal level. Although President Biden supports an increase to $15 an hour, Congress has yet to pass a bill.

As of July 1, 2023, minimum wages have increased in the following states, as follows:

- Alaska - $10.85

- Arizona - $13.85

- California - $15.50

- Colorado - $13.65

- Connecticut - $15.00

- Delaware - $11.75

- District of Columbia - $17.00

- Florida - $12.00 (effective September 30, 2023)

- Illinois - $13.00

- Maine - $13.80

- Maryland - $13.25 (15+ employees)

- Massachusetts - $15.00

- Michigan - $10.10

- Minnesota - $10.59 (annual gross revenues of $500,000+)

- Missouri - $12.00

- Montana - $9.95

- Nebraska - $10.50

- Nevada - $11.25 (w/o benefits)

- New Jersey - $14.13 (6+ employees)

- New Mexico - $12.00

- New York – variable rates based on location

- Ohio - $10.10 (annual gross revenues of $371,000+)

- Oregon – variable rates based on location

- Rhode Island - $13.00

- South Dakota - $10.80

- Vermont - $13.18

- Virginia - $12.00

- Washington - $15.74

Beyond state changes, there are numerous cities and counties enacting new minimum wages:

Arizona

- Flagstaff - $16.80

California

- Belmont - $16.75

- Berkeley - $18.07

- Cupertino - $17.20

- Emeryville - $18.67

- Los Angeles - $16.78

- Mountain View - $18.15

- Oakland - $15.97

- Palo Alto - $17.25

- Pasadena - $16.93

- San Diego - $16.30

- Sunnyvale - $17.95

Colorado

- Denver - $17.29

Illinois

- Chicago - $15.80 (21+ employees)

- Cook County - $13.70

Maryland

- Montgomery County - $16.70 (51+ employees)

New Mexico

- Las Cruces - $12.00

Washington

- Seattle - $18.89 (500+ employees)

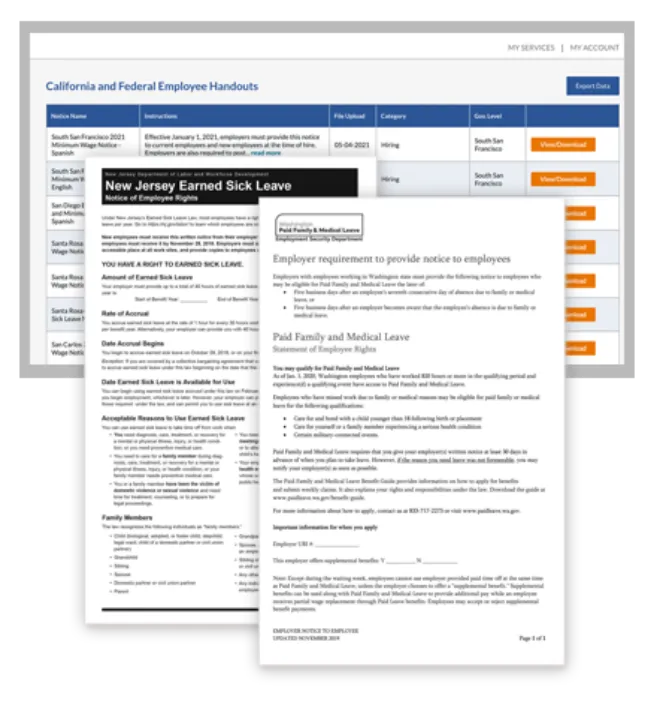

For complete compliance, employers must pay the highest, applicable minimum wage, as well as display all required postings (even if the posters conflict).

Get Details on Current and Future Minimum Wage Activity

The Minimum Wage Monitor™ Premium Service provides an accurate, real-time view of minimum wage rates across the United States. You can easily confirm if your wage rates comply with all applicable laws, in addition to planning ahead for coming changes.

The service includes:

- An interactive, color-coded map with minimum wage data by state, county and city for all 50 states, plus the District of Columbia and Puerto Rico

- Current, past and future minimum wage rates (up to five years) for each location

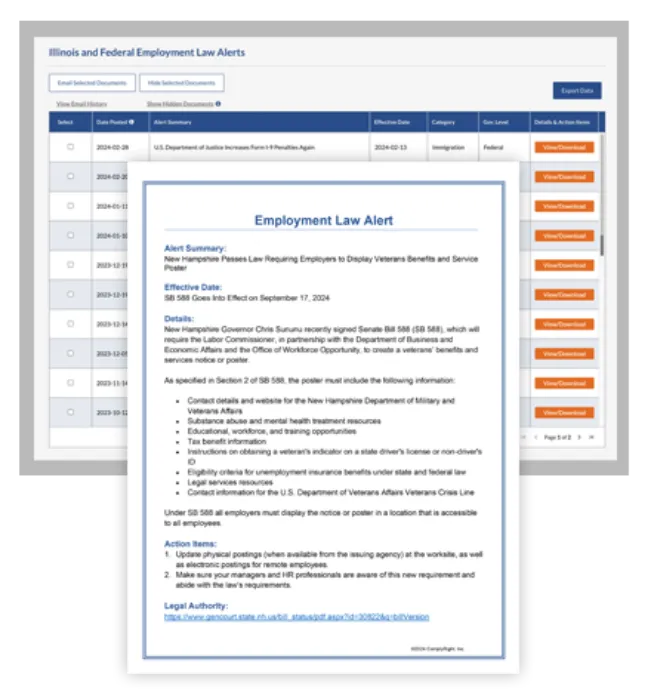

- Automated email notifications whenever federal, state or local minimum wage laws are passed or changed

- Drill-down feature to view the full text of each law, along with the effective date, new wage rate, which employers are affected, and what governs the change (ordinance, statute, consumer price index, etc.)

- Filtering capabilities to isolate rates at each level – federal, state or local

- Real-time data maintenance by in-house legal team

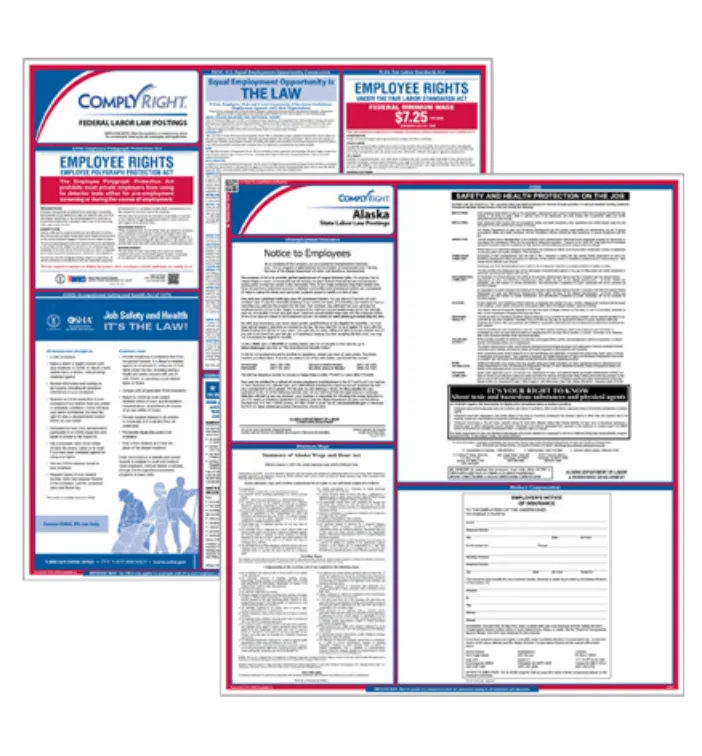

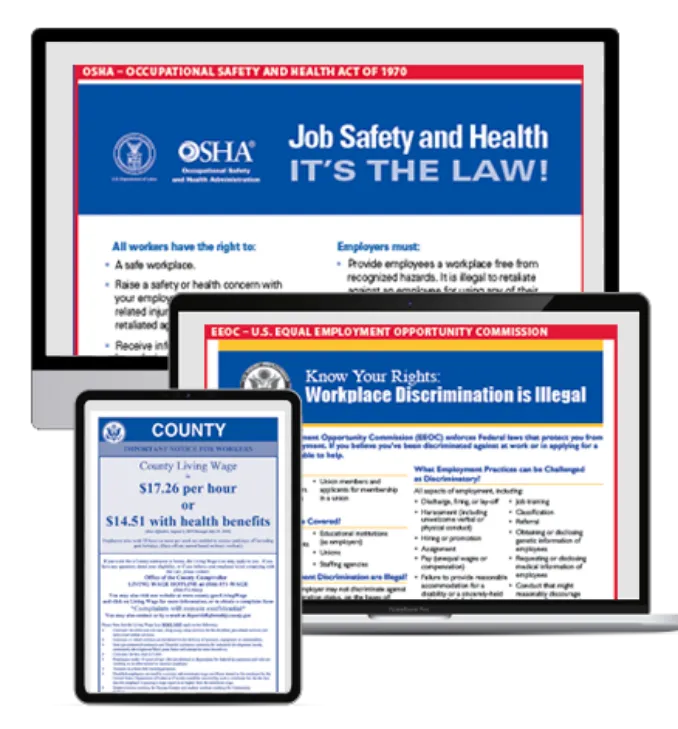

Dedicated Service Keeps Your Workplace Postings Up to Date

Paying hourly employees at least the federal, state, city or county minimum wage (whichever is higher) isn’t your only compliance obligation. You’re also legally required to display certain postings in each business location, including the Fair Labor Standards Act (FLSA) posting that notifies employees of the minimum wage rate, overtime rules and child labor laws.

Poster Guard® Poster Compliance Service provides 365 days of federal, state, county and city posting compliance, as well as automatic replacements with mandatory changes. The result is complete and guaranteed coverage, no matter how many legislative changes (minimum wage or otherwise) occur in a year.