Here are seven key factors to remaining compliant and avoiding legal complications with hourly remote workers:

- Understand nonexempt status — Nonexempt employees are paid an hourly wage and are eligible for overtime pay. They must make at least the legal minimum wage for all hours worked — up to 40 in a workweek. In addition, they must receive overtime pay at the rate of one and one-half times their regular rate for all hours worked over 40 in a workweek.

- Track time carefully — To meet time and pay requirements under the Fair Labor Standards Act (FLSA), you’ll need to carefully track the hours of nonexempt employees. This may be an electronic timekeeping service, which is especially helpful for remote workers. If this is not possible, handwritten time sheets are also acceptable under the FLSA. Whatever method you use, be sure the records accurately reflect dates and times of all work performed. Also, if you allow rounding, such as to the nearest five minutes or quarter of an hour, be sure to do so consistently for all time entries.

- Avoid automatic time entries — Don’t make the mistake of indicating an employee’s scheduled shift hours instead of actual hours worked. For example, don’t report that an employee worked from 9:00 a.m. to 5:00 p.m. each day unless these entries are based on the employee’s actual punch-in/punch-outs. Similarly, avoid making automatic deductions for meals and beaks unless you’re certain the entries reflect actual uninterrupted time.

Be aware: If time records are incomplete or inaccurate — and an employee claims he or she was underpaid — the claim will be nearly impossible to defend.

- Don’t allow “off the clock” work — Working “off the clock” should not be tolerated, as it can lead to unauthorized overtime. Typically, if a nonexempt employee performs any work on your behalf, the employee must be compensated for the time — regardless of whether you expected, requested or authorized the regular or overtime hours. Also, keep in mind that you don’t have to pay for meal or rest breaks if they’re at least 30 minutes, and employees are completely relieved of their work duties. Because this is difficult to monitor when employees aren’t onsite, it’s wise to emphasize the rules upfront with all hourly remote workers.

- Communicate specific remote worker policies — Putting company rules in writing helps set expectations and reduce misunderstandings, both of which are especially important with remote workers. Some items to address are 1) use of company equipment, 2) work schedule and availability, 3) overtime restrictions and approval process, and 4) data security and confidentiality.

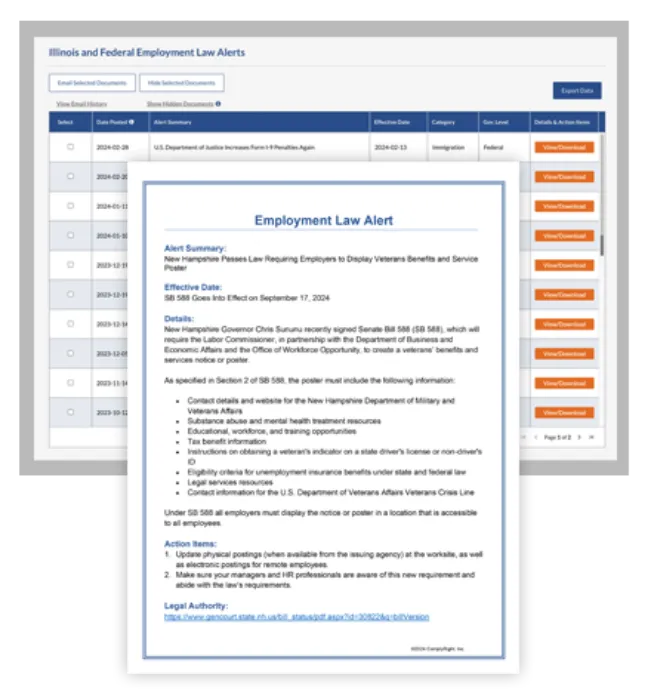

- Uphold other legal requirements — Stay apprised of the various federal, state, county and city laws that pertain to remote workers. This includes the Occupational Safety and Health Administration Act (OSHA Act), which requires employers to provide a safe workplace; workers’ compensation that may cover an injury or illness experienced during remote employment; and the Americans with Disabilities Act (ADA), under which telecommuting may be considered a reasonable accommodation. There’s also the Family and Medical Leave Act (FMLA) and various state and local leave laws that must be managed. If a remote worker needs time off for protected reasons, they should follow the same procedures as onsite employees.

- Provide electronic postings and notifications — Employers must comply with mandatory posting and notification laws even when employees work remotely. In this case, the Department of Labor (DOL) recommends electronic postings for all employees who do not visit a physical work location at least three to four times per month. The DOL also explicitly states that electronic delivery — such as email distribution or intranet links — is an acceptable way to comply.

Did you know? Under new legislation, NY employers must provide electronic copies of mandatory workplace postings to all employees (whether remote or not).

Ensure Continuous Remote Worker Posting Compliance

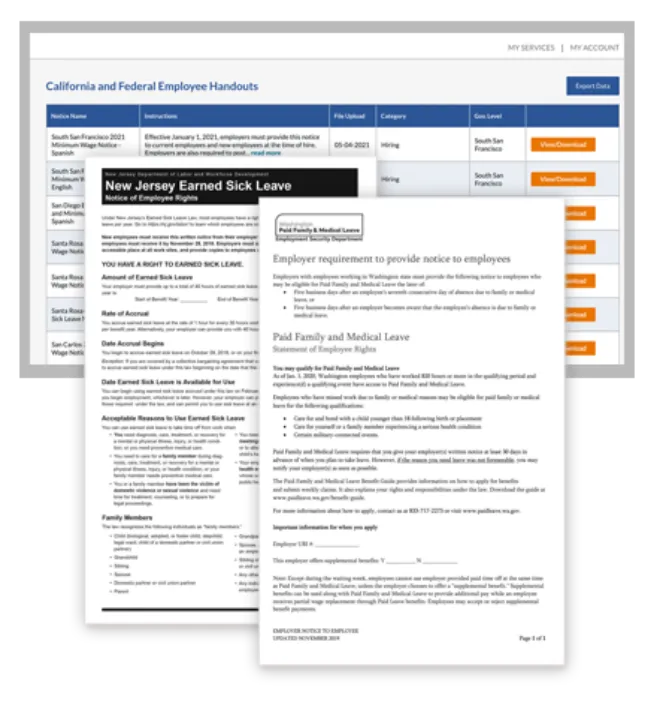

We offer the following solutions to help meet your remote worker posting requirements:

Poster Guard® E-Service for Remote Workers– Provides easy online access to mandatory postings, which is ideal for companies with 10 or fewer remote employees. It’s also a smart solution for larger businesses that want immediate confirmation that employees have accessed the postings.

Intranet Licensing Posting Service 12-Month — Maintain compliance with an easy-to-access link posted on your intranet or dedicated website. Employees just click on the link and select their location to view applicable federal, state, county and city postings.